Onsego Is The Shortest Path To Your GED Diploma

Improve your GED score in just 1 hour a day.

Maximize Results

Study for just 1 hour a day and get results.

Easy and Effective

Focus only on what matters most to improve.

Protect Yourself

Protect yourself from quitting, #1 GED Diploma enemy.

Endorsed by GED Testing Service

Onsego is Officially Recognized for Complete Alignment with the GED Test

And thousands of happy students

Simple and Easy Online GED Classes

Onsego offers online GED classes that are simple and easy. They maximize your potential and boost your confidence.

We provide personalized, innovative courses that make passing the GED a stress-free experience.

We also include bulletproof strategies for effective test-taking. You will discover how to avoid mistakes, what to do instead, and how to study efficiently.

Motivation and Confidence Boost

We realize that passing the GED Test depends on students’ motivation to study and confidence in their performance.

Therefore, we use the principle of small steps to help you achieve your goals and keep you engaged.

How it works

Onsego is Quick and Powerful

Everyone can pass the GED Test, and so can you

Join thousands of students who have earned their GED Diploma with Onsego

Complete GED Prep

Onsego online GED classes cover all 4 GED® subjects. We explain difficult concepts in an easy-to-understand way.

Short Lessons

Onsego’s lessons are clear, concise, and highly focused. You can quickly get to the point, so learn quickly.

Active Learning

Quizzes, practice tests, and flashcards are the active learning tools inside Onsego. They help you to apply what you learn.

progress tracking

Your progress is tracked whenever you take lessons, read text, or answer questions. It always syncs across all devices.

dedicated support

With our top-rated team at your service, you are never alone. Ask us anything, and we listen to your suggestions, too.

Skills Builders

We have many bonuses that build your skills and help you study smarter. From GED Ready vouchers to our Score Booster services.

Onsego Reviews

Onsego made obtaining my GED quick and painless. I was able to get my GED completed in a few months while on unemployment.

It was awesome being able to study whenever I wanted without the hassle of attending classes. The lessons were straightforward and really kept me interested. Doing it all from home was the best part. Now that I’ve got my GED, I’m ready for whatever comes next!

Blair L.

Starting my study for the GED was tough. I had no clue where to begin or what stuff to really dig into.

Using Onsego was a no-brainer for me – it just cuts to the chase and teaches you the stuff you actually gotta know. Super straightforward.- Bridget

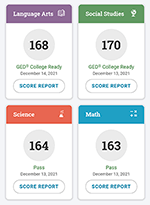

Bridget’s GED Tests Score

I kept failing the GED three times until I gave Onsego a shot. I only regret it took me so long to start with this course.

Onsego practice tests are pretty much like the real GED, but with explanations that show you how to tackle the tricky stuff. Kenny

Kenny’s GED Tests Score

Onsego made me feel understood and supported like they really get where I’m coming from. It’s super uplifting.

It’s like they’ve thought of everything to make GED prep cool and doable. Rodriguez

Rodriguez’s GED Test Score

Getting Your GED Guides

Understand the process

GED Online Explained

If you want to take the GED test online, you must meet some additional requirements. Read More.

GED Test In Your State

While the test is the same in every state, some requirements may vary.

Read More.

What’s on the GED Test

Discover what you need to know to pass the GED test and empower yourself.

Read More.